<Large Cap Value Blend>

American Funds® Washington Mutual FundSM - Class R-3: 482

Overview

- Objective: Income generation and growth of principal through common stock investing.

- Primary Investments: Common stocks with strong earnings and dividend records.

- Category: Large Blend

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Market Cap Focus:

- Top Holdings: Broadcom, Microsoft, UnitedHealth Group, etc.

- Sector Allocation

Risk Profile

- Volatility: Moderate to Low (3yr SD: 15.83)

- Beta (vs. S&P 500): 0.85

- Suitable for balanced risk-return profile.

Costs and Management

- Expense Ratio: Net 0.92%

- Annual Turnover Ratio: 30.00%

Suitability

- balanced approach to growth/income, diversified

- moderate risk, stability alongside growth.

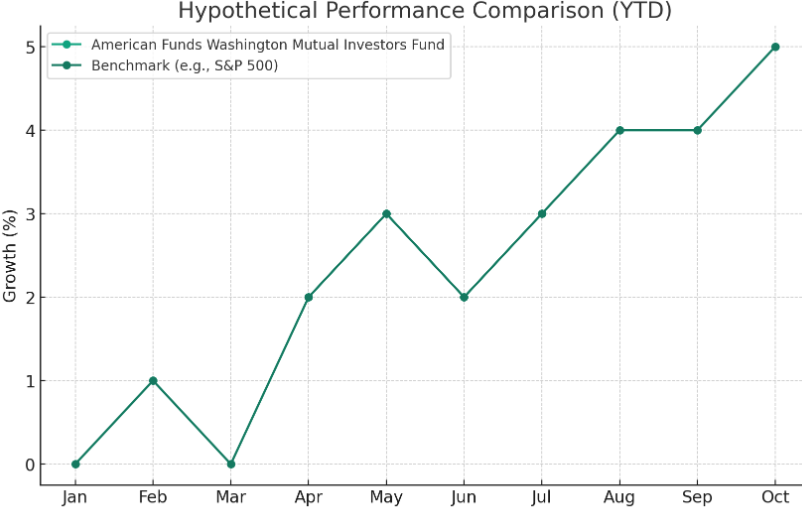

Performance Overview

Key Observations from the Chart:

- stability and moderate growth.

- less volatility than the benchmark, moderate to low risk profile.

seeking steady growth without the high volatility of more aggressive funds.

Massachusetts Investors Trust - Class R2: 714

Overview

- Objective: Capital appreciation.

- Primary Investments: Equity securities, focus on large-cap companies. Includes common stocks

- Category: Large Blend

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Market Cap Focus:

- Top Holdings: Microsoft, Alphabet, Apple, etc.

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 17.00)

- Beta (vs. S&P 500): 0.95

- Suitable for seeking moderate risk exposure.

Costs and Management

- Expense Ratio: Net 0.95%

- Annual Turnover Ratio: 10.00%

Suitability

- balance between growth and moderate risk exposure, suitable for a diversified portfolio.

- The fund's large-cap focus and blend of cyclical and sensitive sectors indicate a potential for stable growth.

Performance Overview

Key Observations from the Chart:

- steady growth pattern, slightly outperforming the benchmark in certain months.

- The fund's performance indicates moderate volatility, in line with its risk profile.

Voya U.S. Stock Index Portfolio - Institutional Class: 829

Overview

- Objective: Total return.

- Primary Investments: 80% of net assets in the S&P 500® or representative securities (+ derivatives).

- Category: Large Blend

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Market Cap Focus:

- Top Holdings: Apple, Microsoft, Amazon, NVIDIA, Alphabet.

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 17.84)

- Beta (vs. S&P 500): 1.00

- Suitable for moderate risk exposure

Costs and Management

- Expense Ratio: Net 0.27%

- Annual Turnover Ratio: 8.00%

Suitability

- market-aligned growth with moderate risk.

- The low expense ratio and passive index-tracking approach make it a cost-effective option.

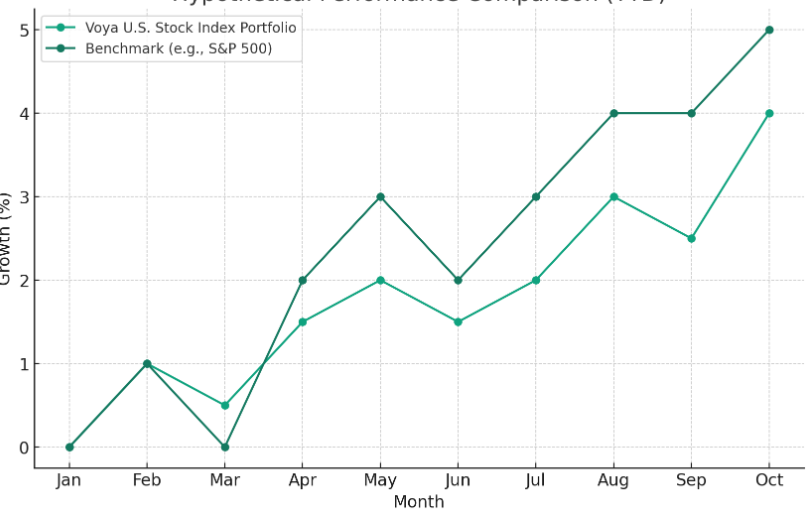

Performance Overview

Key Observations from the Chart:

- closely tracks the benchmark

- steady growth pattern, with the moderate risk

a market-aligned investment, moderate risk exposure. passive index-tracking strategy and low expense ratio make it a cost-effective option for long-term investment.

'투자 계획 및 분석 (영어)' 카테고리의 다른 글

| Analyzing of the VOYA 401K Fund -Asset Allocation (0) | 2023.12.16 |

|---|---|

| Analyzing of the VOYA 401K Fund -Large Capital Growth (0) | 2023.12.16 |

| 2-1. Analyzing Report (2) | 2023.12.06 |

| 2. Medium-Term Investment (1-3 Years) (2) | 2023.12.06 |

| 1-1 Analyzing Report (1) | 2023.12.06 |