PayPal (PYPL)

Business Overview

PayPal Holdings, Inc. is a leading technology platform enabling digital payments and commerce experiences globally. It operates a two-sided network connecting merchants and consumers across over 200 markets, with notable brands like PayPal, Venmo, and Xoom.

Financial Highlights

- Market Capitalization: $64.527 Billion

- Revenue Growth: 8% increase to $21.75B in the last nine months.

- Net Income: 90% increase to $2.84B in the same period.

- BoolioScore: 41.02 out of 100

Financial Ratios and Performance Metrics

- Current Ratio (MRQ): 1.3

- Long-Term Debt/Equity (MRQ): 53.9

- EPS Growth Rate (5 Years): 5.2%

- Revenue Growth Rate (5 Years): 16.0%

- Gross Margin (TTM): 40.2%

- Net Profit Margin (TTM): 12.9%

- Price/Earnings Ratio: 17.77

- Beta: 1.51

Analyst Opinion and Valuation

- Target Price: $74.63 with a potential upside of 24.7%.

- Investment Recommendations: Average opinion of 2.22 (scale 1-5, 1 being strong buy).

- Valuation Models: Show varied intrinsic price estimates, with some indicating potential upside.

Correlation with Economic Indicators

- WTI Crude Oil Price: Positive correlation (0.29535)

- Gold: Strong positive correlation (0.58843)

- US Interest rate (10yrs): Negative correlation (-0.5455)

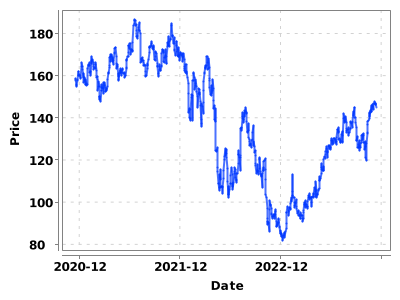

Stock Price Trend

The 5-year price chart shows a general upward trend with recent volatility, reflecting market conditions and company performance.

Investment Consideration for Medium-Term

- Growth Potential: PayPal's consistent revenue growth and expansion in digital payment services align with the increasing trend of online transactions and e-commerce.

- Financial Health: The company's solid financial ratios indicate stability, but a moderate level of debt should be considered.

- Market Position: As a leader in digital payments, PayPal is well-positioned to benefit from the ongoing shift towards cashless transactions.

- Volatility and Risk: The beta of 1.51 suggests higher volatility compared to the market, which could lead to significant price movements.

Conclusion

For a medium-term investment, PayPal presents a mix of growth potential and stability. Its strong market position in the digital payment sector, coupled with solid financials, makes it an attractive option. However, investors should be mindful of its higher volatility and continuously evolving competitive landscape in the FinTech sector.

Amazon (AMZN)

Business Overview

Amazon.com, Inc. is a global leader in e-commerce, cloud computing, and digital streaming. It offers a wide range of products and services, including its own electronic devices and a comprehensive subscription service, Amazon Prime.

Financial Highlights

- Market Capitalization: $1496.78 Billion

- Revenue Growth: 11% increase to $404.82B in the last nine months.

- Net Income: Turned a profit of $19.8B from a loss of $3B.

- BoolioScore: 79.04 out of 100

Financial Ratios and Performance Metrics

- Current Ratio (MRQ): 1.0

- Long-Term Debt/Equity (MRQ): 42.5

- EPS Growth Rate (5 Years): 23.6%

- Revenue Growth Rate (5 Years): 23.6%

- Gross Margin (TTM): 46.2%

- Net Profit Margin (TTM): 3.6%

- Price/Earnings Ratio: 76.51

- Beta: 1.34

Analyst Opinion and Valuation

- Target Price: $173.56 with a potential upside of 19.83%.

- Investment Recommendations: Strong buy/buy sentiment with an average opinion of 1.7 (scale 1-5, 1 being strong buy).

Correlation with Economic Indicators

- WTI Crude Oil Price: Positive correlation (0.42492)

- Gold: Strong positive correlation (0.71557)

- US Interest rate (10yrs): Negative correlation (-0.52464)

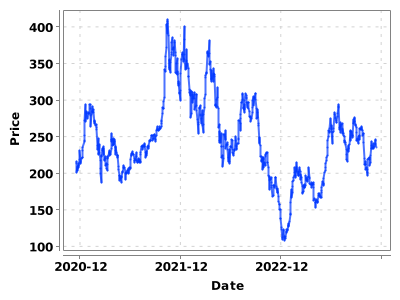

Stock Price Trend

The 5-year price chart shows a significant upward trend, reflecting Amazon's strong market position and growth.

Investment Consideration for Medium-Term

- Market Dominance: Amazon's leading position in e-commerce and cloud services (AWS) provides a strong foundation for continued growth.

- Financial Health: The company's solid financial performance and growth metrics indicate a robust business model.

- Innovation and Diversification: Continuous innovation and diversification into new markets (like AI and media) present opportunities for growth.

- Volatility and Risk: The beta of 1.34 suggests moderate volatility, aligning with its growth-oriented nature.

Conclusion

Amazon represents a compelling medium-term investment opportunity due to its market leadership, financial strength, and continuous innovation. Its diverse business model and strong growth prospects make it a suitable candidate for investors seeking growth with a moderate level of risk. However, its high P/E ratio indicates a premium valuation, which should be considered in the investment decision.

Tesla (TSLA)

Business Overview

Tesla, Inc. is a pioneer in electric vehicles (EVs), energy generation, and storage systems. It designs, develops, manufactures, and sells fully electric vehicles and related products. Tesla's product line includes the Model 3, Model Y, Model S, Model X, Powerwall, and Megapack.

Financial Highlights

- Market Capitalization: $748.89 Billion

- Revenue Growth: 25% increase to $71.61B in the last nine months.

- Net Income: Decreased by 20% to $7.07B.

- BoolioScore: 50.05 out of 100

Financial Ratios and Performance Metrics

- Current Ratio (MRQ): 1.7

- Long-Term Debt/Equity (MRQ): 4.5

- EPS Growth Rate (5 Years): 47.3%

- Revenue Growth Rate (5 Years): 47.3%

- Gross Margin (TTM): 19.8%

- Net Profit Margin (TTM): 11.2%

- Price/Earnings Ratio: 77.00

- Beta: 1.86

Analyst Opinion and Valuation

- Target Price: $224.9 with a potential downside of -4.53%.

- Investment Recommendations: Mixed opinions with an average rating of 2.78 (scale 1-5, 1 being strong buy).

Correlation with Economic Indicators

- WTI Crude Oil Price: Positive correlation (0.37224)

- Gold: Strong positive correlation (0.60123)

- US Interest rate (10yrs): Negative correlation (-0.28397)

Stock Price Trend

The 5-year price chart shows significant growth with notable volatility, reflecting Tesla's dynamic market position and investor sentiment.

Investment Consideration for Medium-Term

- Innovation Leader: Tesla's leading position in the EV market and its continuous innovation in energy solutions present strong growth potential.

- Financial Health: Despite recent net income decrease, Tesla shows robust revenue growth and a solid financial position.

- Market Dynamics: The shift towards sustainable energy and electric vehicles supports Tesla's long-term growth.

- Volatility and Risk: High beta indicates significant volatility, which could lead to substantial price movements.

Conclusion

Tesla is a high-growth, high-volatility investment suitable for medium-term investors who are comfortable with risk. Its leadership in the EV sector and innovative approach position it well for future growth. However, its high valuation and recent income decrease should be carefully considered in investment decisions.

(본 자료는 개인 투자 목적으로 작성되었습니다. 이 자료는 참고용으로 활용하실 수 있으나, 투자 결정에 따른 책임은 사용자 본인에게 있음을 명시합니다.)

'투자 계획 및 분석 (영어)' 카테고리의 다른 글

| Analyzing of the VOYA 401K Fund -Large Cap Value Blend (0) | 2023.12.16 |

|---|---|

| Analyzing of the VOYA 401K Fund -Large Capital Growth (0) | 2023.12.16 |

| 2. Medium-Term Investment (1-3 Years) (2) | 2023.12.06 |

| 1-1 Analyzing Report (1) | 2023.12.06 |

| 1. Long-Term Investment (10+ years) (2) | 2023.12.06 |