Alphabet Inc. (GOOGL)

Business Overview

Alphabet Inc., the parent company of Google, operates in various segments including Google Services (ads, Android, Chrome, hardware, Google Maps, Google Play, Search, YouTube), Google Cloud, and Other Bets (health technology, Internet services). It is a leader in online advertising, search engine technology, cloud computing, and AI.

Financial Highlights

- Market Capitalization: $1625.73 Billion

- Revenue Growth: 7% increase to $221.08B in the last nine months.

- Net Income: Increased by 15% to $53.11B.

Financial Ratios and Performance Metrics

- Current Ratio (MRQ): 2.0

- Long-Term Debt/Equity (MRQ): 5.0

- EPS Growth Rate (5 Years): 23.3%

- Revenue Growth Rate (5 Years): 20.6%

- Gross Margin (TTM): 56.1%

- Net Profit Margin (TTM): 22.5%

- Price/Earnings Ratio: 25.29

- Beta: 1.19

Analyst Opinion and Valuation

- Target Price: $151.71 with a potential upside of 17.36%.

- Recommendations: Strong buy/buy sentiment with an average opinion of 1.92 (scale 1-5, 1 being strong buy).

Correlation with Economic Indicators

- WTI Crude Oil Price: Positive correlation (0.54655)

- Gold: Strong positive correlation (0.7649)

- US Interest rate (10yrs): Negative correlation (-0.48758)

Stock Price Trend

consistent upward trend, reflecting Alphabet's strong market position and growth.

Investment Consideration for Long-Term

- Market Leadership: Alphabet's dominance in search and online advertising, along with its growing presence in cloud computing, positions it well for sustained growth.

- Innovation and Diversification: Continuous innovation and diversification into new technologies like AI and autonomous vehicles present long-term growth opportunities.

- Financial Health: Strong financial metrics, including revenue growth and profit margins, indicate a robust business model.

- Stability and Risk: Moderate beta suggests lower volatility compared to the broader market, making it a relatively stable investment for the long term.

Conclusion

Alphabet represents a strong long-term investment opportunity due to its market leadership, continuous innovation, and solid financial health. Its diversified business model and commitment to technological advancement make it well-positioned to capitalize on future trends in the tech industry. However, investors should be aware of potential regulatory challenges and competitive pressures in the tech sector.

Johnson & Johnson (JNJ)

Business Overview

Johnson & Johnson is a globally diversified healthcare company engaged in the research, development, manufacture, and sale of a broad range of products in the healthcare field. It operates through two main segments: Pharmaceutical and MedTech, focusing on areas such as Immunology, Infectious Diseases, Neuroscience, Oncology, Cardiovascular, Metabolism, and Pulmonary Hypertension.

Financial Highlights

- Market Capitalization: $382.468 Billion

- Revenue Growth: 6% increase to $63.76B in the last nine months.

- Net Income: Decreased by 30% to $9.19B.

Financial Ratios and Performance Metrics

- Current Ratio (MRQ): 1.2

- Long-Term Debt/Equity (MRQ): 36.6

- EPS Growth Rate (5 Years): 5.3%

- Revenue Growth Rate (5 Years): 4.4%

- Gross Margin (TTM): 68.9%

- Net Profit Margin (TTM): 14.5%

- Price/Earnings Ratio: 32.60

- Beta: 0.34

Analyst Opinion and Valuation

- Target Price: $175.1 with a potential upside of 10.21%.

- Recommendations: Mixed opinions with an average rating of 2.35 (scale 1-5, 1 being strong buy).

Correlation with Economic Indicators

- WTI Crude Oil Price: Positive correlation (0.65837)

- Gold: Strong positive correlation (0.78298)

- US Interest rate (10yrs): Negative correlation (-0.57632)

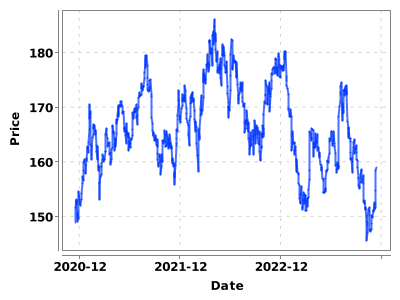

Stock Price Trend

steady trend with less volatility, reflecting Johnson & Johnson's stable market position.

Investment Consideration for Long-Term

- Diversified Healthcare Leader: JNJ's diversified portfolio in pharmaceuticals and medical devices provides a

- balanced mix of growth and stability.

- Innovation and Research: Continuous investment in R&D and a strong pipeline of new products support long-term growth.

- Financial Health: Solid financial metrics, including a strong gross margin and consistent revenue growth, indicate a robust business model.

- Stability and Risk: Low beta suggests lower volatility and a stable investment suitable for long-term portfolios.

Conclusion

Johnson & Johnson represents a solid long term investment opportunity due to its diversified healthcare portfolio, consistent financial performance, and commitment to innovation. Its position as a leader in various healthcare segments makes it a resilient choice for long-term investors. However, investors should consider the potential impact of regulatory changes and market competition in the healthcare sector.

Microsoft Corporation (MSFT)

Business Overview

Microsoft Corporation is a leading technology company with a diverse portfolio in software, services, devices, and solutions. Its key segments include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing, encompassing products like Office, LinkedIn, Dynamics, Azure, SQL Server, Windows, and gaming.

Financial Highlights

- Market Capitalization: $2743.54 Billion

- Revenue Growth: 13% increase to $56.52B in the last quarter.

- Net Income: Increased by 27% to $22.29B.

Financial Ratios and Performance Metrics

- Current Ratio (MRQ): 1.7

- Long-Term Debt/Equity (MRQ): 26.5

- EPS Growth Rate (5 Years): 20.0%

- Revenue Growth Rate (5 Years): 13.9%

- Gross Margin (TTM): 69.4%

- Net Profit Margin (TTM): 35.3%

- Price/Earnings Ratio: 36.27

- Beta: 1.05

Analyst Opinion and Valuation

- Target Price: $405.53 with a potential upside of 9.86%.

- Recommendations: Strong buy/buy sentiment with an average opinion of 1.73 (scale 1-5, 1 being strong buy).

Correlation with Economic Indicators

- WTI Crude Oil Price: Positive correlation (0.46909)

- Gold: Strong positive correlation (0.68084)

- US Interest rate (10yrs): Negative correlation (-0.35008)

Stock Price Trend

strong upward trend, reflecting Microsoft's robust market position and consistent growth.

Investment Consideration for Long-Term

- Market Leadership: Microsoft's strong position in software, cloud computing, and enterprise services underpins its long-term growth.

- Innovation and Expansion: Continuous innovation and expansion into new technology areas like AI and cybersecurit.

- Financial Strength: Impressive financial performance with high growth rates in revenue and net income.

- Stability and Risk: Moderate beta indicates lower volatility, making it a suitable choice for long-term investment.

Conclusion

Microsoft Corporation is an attractive long term investment due to its market dominance, continuous innovation, and strong financial health. Its diverse product portfolio and strategic investments in emerging technologies position it well for sustained growth over the long term. The company's stability and lower risk profile make it a compelling choice for long-term investors.

'투자 계획 및 분석 (영어)' 카테고리의 다른 글

| Analyzing of the VOYA 401K Fund -Large Capital Growth (0) | 2023.12.16 |

|---|---|

| 2-1. Analyzing Report (2) | 2023.12.06 |

| 2. Medium-Term Investment (1-3 Years) (2) | 2023.12.06 |

| 1. Long-Term Investment (10+ years) (2) | 2023.12.06 |

| Investment Planning by Time Horizons (2) | 2023.12.06 |