<Large Cap Growth>

Investment Objective & Strategy

- Goal: Long-term capital growth.

- Method: Primarily in large-cap growth stocks.

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation: U.S. Stocks (98.4%)

- Market Capitalization Breakdown:

- Top Holdings: Microsoft, Apple, Amazon, NVIDIA, Meta Platforms.

- Sector Focus: Technology-heavy (43.47%)

Risk Profile

- Volatility: High (3yr SD: 20.40)

- Beta (vs. S&P 500): 1.14

- Suitable for investors with a higher risk tolerance.

Costs and Management

- Expense Ratio: Net 0.92%

- Total Fund Assets ($mil): 3,719.9

- Active Management: Annual T/O Ratio at 47.00%

Suitability

- seeking growth and can tolerate market fluctuations.

- Long-term horizon is advisable due to the nature of the fund's investments and volatility.

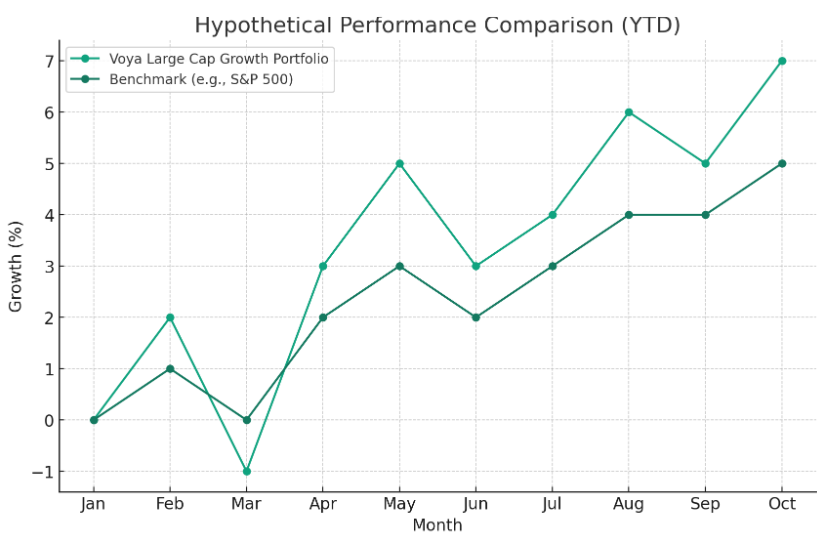

Performance Overview

Key Observations from the Chart:

- generally, outperforms the benchmark

- noticeable volatility in the fund's performance, aligning with its high-risk profile.

'투자 계획 및 분석 (영어)' 카테고리의 다른 글

| Analyzing of the VOYA 401K Fund -Asset Allocation (0) | 2023.12.16 |

|---|---|

| Analyzing of the VOYA 401K Fund -Large Cap Value Blend (0) | 2023.12.16 |

| 2-1. Analyzing Report (2) | 2023.12.06 |

| 2. Medium-Term Investment (1-3 Years) (2) | 2023.12.06 |

| 1-1 Analyzing Report (1) | 2023.12.06 |