Voya Index Solution 2025 Portfolio - Service Class: 1540

Overview

- Objective: targeted at retirement around 2025.

- Primary Investments: 80% in passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 08-31-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 11.60)

- Beta (vs. S&P 500): 0.65

- for nearing retirement, seeking a balance of return and stability.

Costs

- Expense Ratio: Net 0.44%

- Annual Turnover Ratio: 50.00%

Suitability

- designed for those expecting to retire soon, focusing on a mix of growth and income.

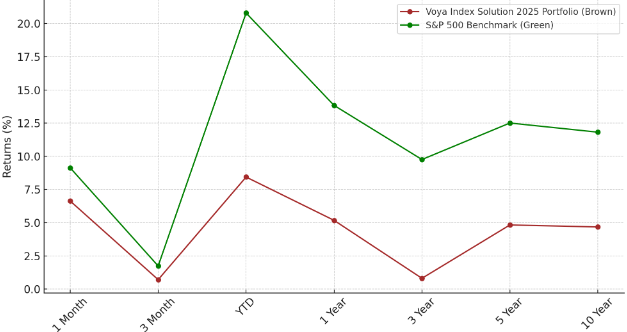

Performance chart

Key Observations

- emphasizes capital preservation and income generation as it approaches the 2025

- reflects a conservative approach, with a higher bond allocation to mitigate volatility and preserve capital.

suitable for seeking a diversified, conservative strategy with a focus on retirement planning for nearing the retirement phase.

Voya Index Solution 2030 Portfolio - Service Class: 6766

Overview

- Objective: targeted at retirement around 2030.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 12.98)

- Beta (vs. S&P 500): 0.73

- for moderate risk tolerance and a retirement target around 2030.

Costs

- Expense Ratio: Net 0.47%

- Annual Turnover Ratio: 52.00%

Suitability

- as the target date approaches, shifting towards more conservative investments.

Performance chart

Key Observations

- focuses on a balance between growth and capital

- The diversified investment approach, suggest a strategy aimed at steady growth with controlled volatility.

suitable for seeking a diversified, evolving asset allocation and moderate risk management are tailored for those with a medium-term investment timeframe.

Voya Index Solution 2035 Portfolio - Service Class: 1543

Overview

- Objective: targeted at retirement in around 2035.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Top Holdings: Diverse range of index funds.

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 14.50)

- Beta (vs. S&P 500): 0.81

- Suitable for investors with a moderate risk tolerance.

Costs

- Expense Ratio: Net 0.46%

- Annual Turnover Ratio: 41.00%

Suitability

- as the target date approaches, shifting towards more conservative investments.

Performance chart

Key Observations

- diversified allocation across stocks and bonds suggests a balanced approach to risk and return.

- As the target date approaches, allocation is likely to shift towards more conservative investments(bonds and cash)

focus on a balanced and evolving asset allocation as the retirement date approaches.

Voya Index Solution 2040 Portfolio - Service Class: 6769

Overview

- Objective: targeted at retirement around 2040.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 15.69)

- Beta (vs. S&P 500): 0.88

- Suitable for investors with a moderate risk tolerance.

Costs

- Expense Ratio: Net 0.50%

- Annual Turnover Ratio: 40.00%

Suitability

- as the target date approaches, shifting towards more conservative investments.

Performance chart

Key Observations

- focuses on a balance between growth and capital preservation as it moves closer to 2040.

- strategy aimed at achieving steady growth with controlled volatility.

for investors seeking a diversified, evolving asset allocation and moderate risk management are tailored for long-term investment.

Voya Index Solution 2045 Portfolio - Service Class: 1546

Overview

- Objective: targeted at retirement in approximately 2045.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 16.41)

- Beta (vs. S&P 500): 0.92

- Suitable for a moderate risk tolerance.

Costs

- Expense Ratio: Net 0.46%

- Annual Turnover Ratio: 39.00%

Suitability

- evolving as the target date approaches, shifting towards more conservative investments.

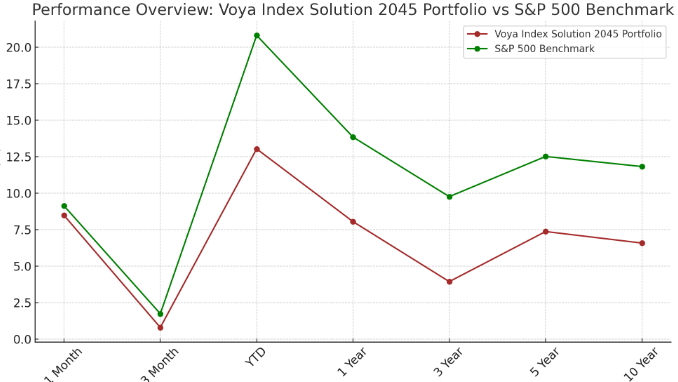

Performance chart

Key Observations

- diversified allocation across stocks and bonds suggests a balanced approach to risk and return.

suitable for a target-date retirement strategy, with a focus on a balanced and evolving asset allocation as the retirement date approaches.

Voya Index Solution 2050 Portfolio - Service Class: 6772

Overview

- Objective: targeted at retirement in approximately 2050.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 16.66)

- Beta (vs. S&P 500): 0.93

- Suitable for moderate risk tolerance.

Costs

- Expense Ratio: Net 0.53%

- Annual Turnover Ratio: 34.00%

Suitability

- evolves as the target date approaches, shifting towards more conservative investments.

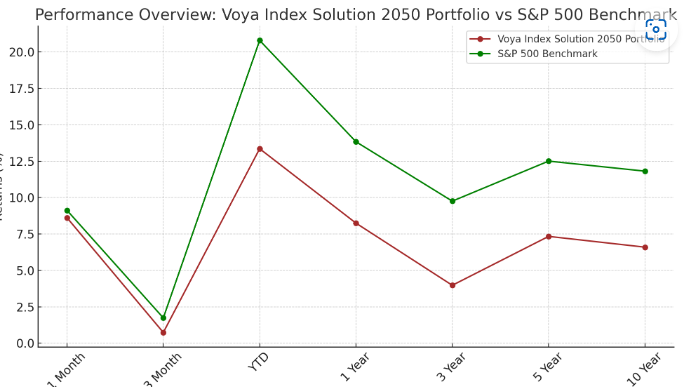

Performance chart

Key Observations

- focuses on growth investments with a long-term

- The diversified approach and moderate risk profile suggest a strategy aiming for steady growth with controlled volatility.

suitable choice for diversified, long-term strategy. Its evolving asset allocation and moderate risk management are tailored for those with a longer investment timeframe.

Voya Index Solution 2055 Portfolio - Service Class: 1162

Overview

- Objective: targeted at retirement in 2055.

- Primary Investments: 80% in passively managed index funds (U.S. and global stocks, U.S. bonds, and other fixed-income).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Top Holdings: Diverse range of index funds.

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Yr SD: 16.77)

- Beta (vs. S&P 500): 0.94

- Suitable for long-term.

Costs and Management

- Expense Ratio: Net 0.52%

- Annual Turnover Ratio: 34.00%

Suitability

- Ideal for the long-term.

- The fund's diversified and dynamic asset allocation strategy evolves as the target date approaches, becoming more conservative.

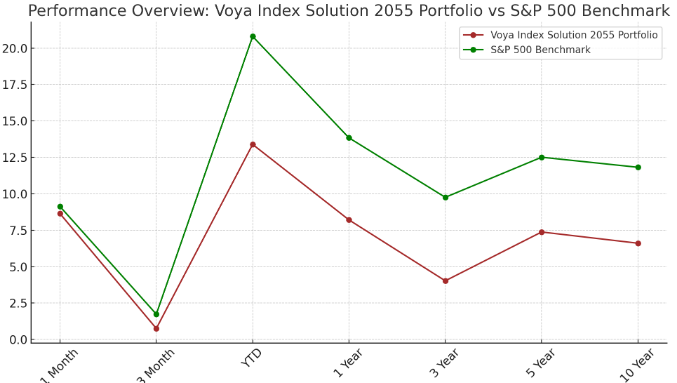

Performance Overview

Key Observations from the Chart:

- mirrors the overall market trends (diversified)

- balance between growth and stability

diversified and dynamic asset allocation; a mix of growth and stability, adapting as the target retirement date approaches.

Voya Index Solution 2060 Portfolio - Service Class: 3212

Overview

- Objective: targeted at retirement in 2060.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income).

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 16.91)

- Beta (vs. S&P 500): 0.95

- Suitable for moderate risk tolerance.

Costs

- Expense Ratio: Net 0.55%

- Annual Turnover Ratio: 34.00%

Suitability

- Ideal for younger investors with a longer time horizon.

- strategy is designed for investors expecting to retire around the year 2060, evolving as the target date approaches.

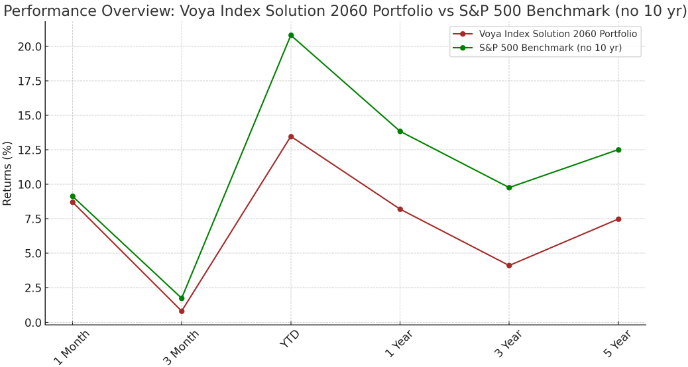

Performance Overview

Key Observations

- The fund's diversified allocation across stocks and bonds suggests a balanced approach to risk and return.

- As the target date approaches, shift towards more conservative investments, such as bonds and cash.

suitable for who are looking for a target-date retirement strategy, focusing on a balanced and evolving asset allocation as the retirement date approaches.

Voya Index Solution 2065 Portfolio - Service Class: E476

Overview

- Objective: targeted at retirement in around 2065.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments).

Key Portfolio Metrics (as of 08-31-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Moderate (3-Year SD: 17.02)

- Beta (vs. S&P 500): 0.95

- Suitable for long-term investment horizon

Costs

- Expense Ratio: Net 0.62%

- Annual Turnover Ratio: 51.00%

Suitability

- Ideal for younger investors with a long-term horizon.

- evolves as the target date approaches, shifting towards more conservative investments.

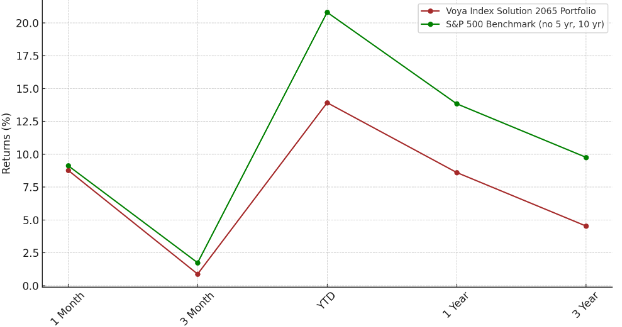

Performance Overview

Key Observations

- growth-oriented investments, given its long-term target

- The diversified investment approach and moderate risk, aiming for steady growth with controlled volatility

for investors seeking a diversified, long-term strategy. Its evolving asset allocation and moderate risk management are tailored for those with a longer investment timeframe.

Voya Index Solution Income Portfolio - Service Class: 1549

Overview

- Objective: Combination of total return and stability of principal, targeted to retirement.

- Primary Investments: 80% in underlying passively managed index funds (U.S. stocks, international stocks, U.S. bonds, and other fixed-income instruments), mainly for investors close to or in retirement.

Key Portfolio Metrics (as of 09-30-23)

- Asset Allocation:

- Sector Allocation:

Risk Profile

- Volatility: Low to Moderate (3-Year SD: 8.70)

- Beta (vs. S&P 500): 0.69

- Suitable for seeking stability and total return, particularly those nearing or in retirement.

Costs

- Expense Ratio: Net 0.43%

- Annual Turnover Ratio: 51.00%

Suitability

- Ideal for investors nearing or already in retirement.

- designed for those expecting to retire soon or who are already retired, focusing on stability and income.

Performance Overview

Key Observations

- The fund's significant bond allocation and lower exposure to stocks reflect its focus on income generation and principal stability.

- Its asset allocation is geared towards investors who require steady income with lower volatility, making it appropriate for those close to or in retirement.

This fund is well-suited for investors with a near-term retirement horizon or those already retired, looking for a balance of income and capital preservation.

'투자 계획 및 분석 (영어)' 카테고리의 다른 글

| Analyzing of the VOYA 401K Fund -Large Cap Value Blend (0) | 2023.12.16 |

|---|---|

| Analyzing of the VOYA 401K Fund -Large Capital Growth (0) | 2023.12.16 |

| 2-1. Analyzing Report (2) | 2023.12.06 |

| 2. Medium-Term Investment (1-3 Years) (2) | 2023.12.06 |

| 1-1 Analyzing Report (1) | 2023.12.06 |